Image credit: Unsplash

ION supplies trading workflow automation software, analytics and insights, and strategic consulting to its clients. Their services “simplify complex processes, boost efficiency, and enable better decision-making” to financial institutions, central banks, governments, and corporate organizations.

A global provider of personalized, predictive data and market intelligence, ION Analytics serves advisers, investors, law firms, and corporates. ION Analytics helps clients find opportunities and make better decisions in markets. It supplies individualized, targeted data, market intelligence, and software to varied clients.

Vintage Investment Partners (Vintage) has selected ION-owned Backstop Solutions (Backstop) to support its fundraising, investor relations, and investor communication initiatives.

Head of Investor Sales at Ion Analytics, Greg Fuji, says, “As a top provider of CRM and portal solutions, we are honored to support Vintage in their fundraising, investor relations, and investor communications processes. Our CRM, investor relations, and investor portal platform is designed to meet the unique client-side needs of venture capital firms, and we are thrilled to partner with Vintage to help them achieve their growth ambitions. We look forward to working closely with the firm, supporting them to streamline operations further, enhance decision-making, and drive their success in global venture capital.”

Vintage Investment Partners, a Global Venture Firm

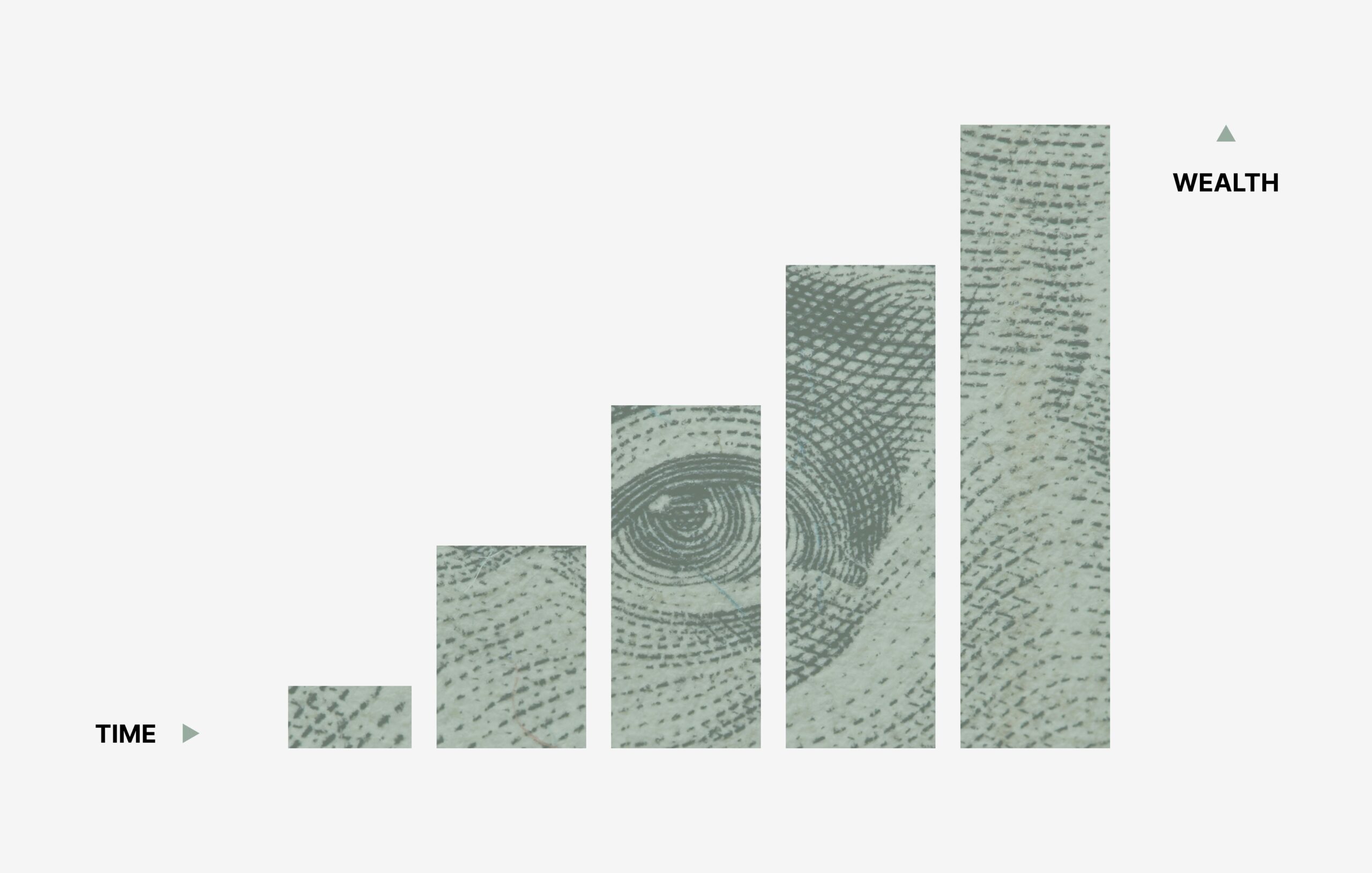

Vintage Investment Partners invests in leading funds and startups in the USA, Europe, and Israel. It is a global investment fund with $4 billion in assets under management. With 15 active funds, Vintage Investment Partners has invested in some of the world’s leading venture funds, providing exposure to more than 6,000 tech companies. It invests by combining fund-of-fund, secondary fund, and growth fund investments. Using its extensive network, it connects startups across the world to corporations willing to support their ambitions and maximize their potential.

The firm was seeking a platform for its fundraising, investor relations, and investor communications while also working to streamline its data, workflow, and reporting. Backstop Solutions will provide a comprehensive and reliable view of the investor lifecycle as well as support communications, collaboration, and decision-making across Vintage Investment Partners.

Venture capital firms like Vintage Investment Partners need holistic solutions for managing fundraising, investor relations, and investor communications. Backstop Solutions offers user-friendly, industry-focused CRM, investor relations, and investor portal features. Additionally, Backstop Solutions boasts extensive customer support, and the platform is optimal for fundraising, investor relations, investor communications, and reporting. The platform’s tools, including code-free configuration, simple subscription model, and venture capital specialization, make it easy for Vintage Investment Partners to access everything they require in one suite.

Head of Investor Relations at Vintage Investment Partners, Jonathan Alend, SVP, says, “We’re excited to partner with ION Analytics, bringing Backstop Solutions onboard to help us with our investor relations, fundraising, and investor communication needs. After a thorough evaluation and selection process, we found Backstop’s platform to be the most user-friendly and intuitive, and its workflow will help us to streamline our investor processes. Combining CRM, investor relations, and portal in one place will help us consolidate data and improve reporting. As our fundraising plans evolve in 2024 and beyond, we must ensure that our technology solutions remain aligned with organizations’ and clients’ needs. We believe this platform is the right choice for Vintage Investment Partners.”

Vintage Investment Partners Raised $200 Million

Earlier this year, Vintage Investment Partners raised $200 million, closing out its 4th growth-stage venture fund. Like previous growth funds, Vintage chose to invest in 15-20 Israeli, European, and U.S. growth-stage tech startups.

Asaf Horesh, General Partner at Vintage Investment Partners said, “We raised most of the money during last summer and continued during the war with several entities that we had already worked with, reaching over $200 million,” He added, “We believe there are ample opportunities in the market. In principle, we strive to invest in the best companies across all sectors, and our strongest relationships are in Israel. We also have several European and American companies in our portfolio.”