Image credit: Unsplash

The Securities and Exchange Commission (SEC) is suing Matthew Brown, an aspirant venture capitalist and owner of Matthew Brown Companies LLC, for allegedly making a false attempt to buy Richard Branson’s satellite firm, Virgin Orbit. The SEC claims that in March 2023, Brown emailed a forged image of his bank account in which he claimed to have $182 million when, in reality, he had less than $1.

Brown reportedly used LinkedIn to contact Vice President of Investor Relations and CEO of Virgin Orbit, Dan Hart, claiming he could provide funding for the $200 million acquisition of the business. After he made his assertion, rumors of the possible transaction started to circulate, which caused Virgin Orbit’s shares to increase 33.1%. Brown then made an appearance on CNBC, where he was presented as a defense and energy advisor to President Joe Biden’s government. Brown made a misleading impression during his visit, saying he was a seasoned venture investor who had made significant investments in more than 13 space firms.

According to the SEC lawsuit, Brown asked Virgin Orbit for a “break-up fee,” but the business refused. He tried his best, but the transaction fell through. The SEC has asked for a civil trial by jury in this matter.

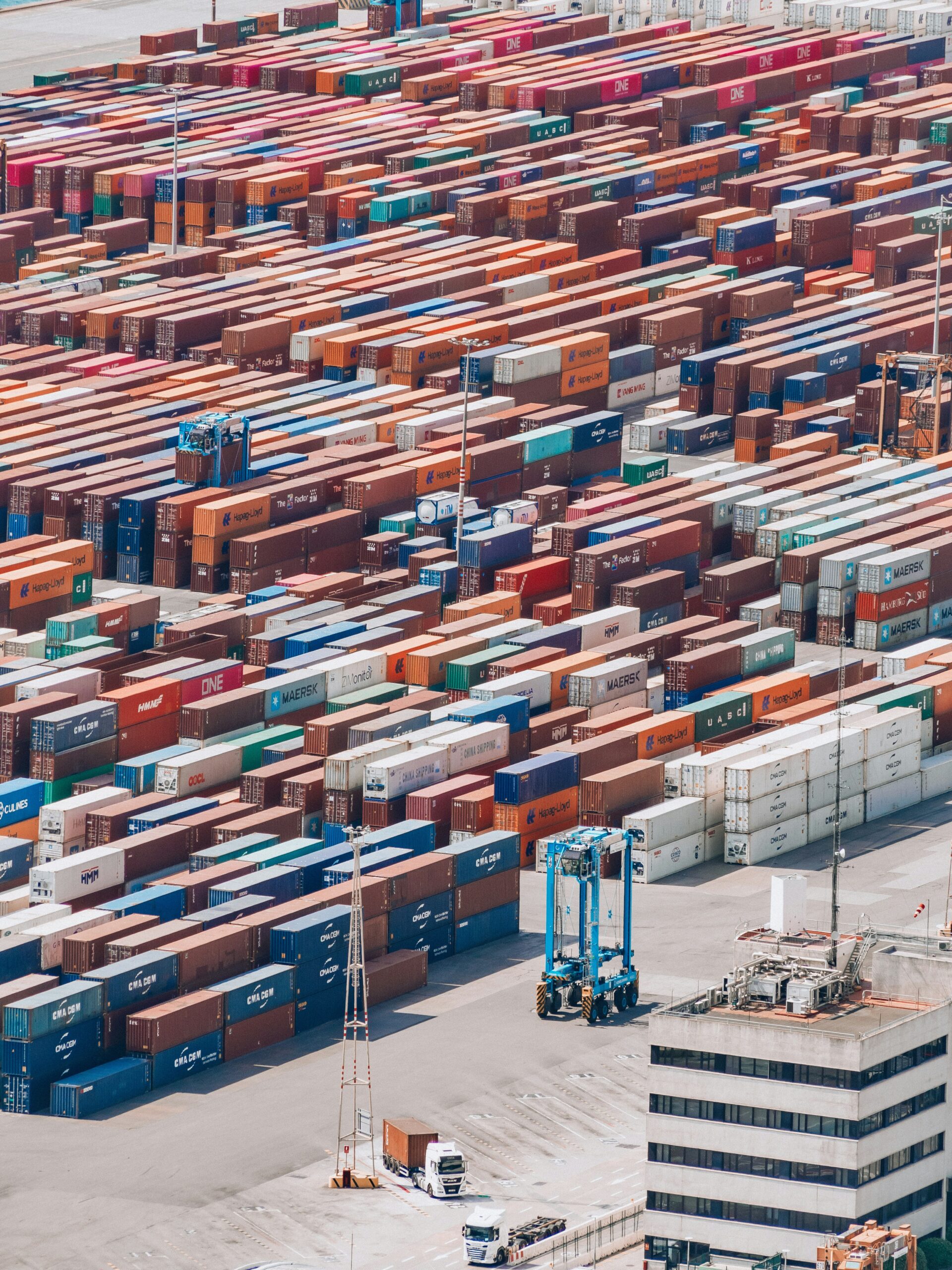

When Virgin Orbit was founded in 2017, its primary goal was to put tiny satellites into orbit. Unfortunately, the business filed for Chapter 11 bankruptcy in May 2023, at which point it completely stopped operating. After that, four successful bids purchased its assets. Virgin Orbit was established by the Richard Branson-led Virgin Group, which is home to more than 400 businesses, including Virgin Records and Virgin Atlantic.

According to Matthew Brown’s LinkedIn page, he is a general partner and senior executive partner of the climate-focused investment management business Energent, LP, as well as a stakeholder and senior adviser of the aerospace venture capital firm Partager. A representative for Brown responded to the SEC case by stating that it contained “egregious errors, fabrications, and biased allegations” that benefited the management of Virgin Orbit. According to the spokesman, Brown was approached by Virgin Orbit for an investment, and during the first conversations, a non-binding letter of intent was created. However, Brown and his business chose not to invest after doing their due diligence.

The spokesman went on to say that Brown and his business plan was to contest the accusations and that they wouldn’t give up until they were proven right by the law.

Virgin Orbit’s brief tenure in the space sector came to an end with its bankruptcy and subsequent asset sale. The action filed by the SEC against Brown brings to light the difficulties and scrutiny that venture capitalists and the businesses they want to invest in must deal with. The case also emphasizes how crucial honesty and openness are in financial transactions, especially in high-stakes sectors like technology and aerospace.

Brown’s legal issues arise at a moment when the venture capital sector is being scrutinized more and more for its claims and methods. The verdict in this case may have asignificantg impact on Brown’s career in the business as well as the overall regulations that venture investors must abide by.

The severity of the charges against Brown is demonstrated by the SEC’s desire for a civil trial with a jury. Regulators, legal experts, and people in the aerospace and venture capital sectors will be keenly following this issue as it develops. The case serves as a reminder of the need to conduct due diligence before making an investment and the possible legal and reputational consequences involved in making false representations in financial transactions.