Image credit: Unsplash

No matter how many times you practice your pitch in the bathroom mirror, analyzing every word, inflection, and facial expression—at the end of the day, it’s your personality that matters most. With many investors proceeding more cautiously, the financial landscape for founders is proving more challenging in recent years.

Venture capital is about more than funding the next big thing. Investors want to back the visionaries and innovators who are making big things happen. While venture capitalists consider various factors, like careful examination of the founder’s skills, background, and achievements, they often rely most on their instincts, a skill sharpened through years of experience.

Yet investors also know that the individuals behind the venture ultimately determine its course and success. Emerging research emphasizes the critical role a founder’s personality plays in determining a startup’s potential for success. Below are the top five personality traits that set investor-worthy founders apart from the pack:

1. A Strong Commitment to Work as a Top Priority: The startup world certainly has its challenges, from unexpected setbacks and economic downturns to cash flow crunches and market volatility. These challenges demand swift action and long hours, and individuals who put hard work at the top of their priority list while finding a sustainable work/life balance, prioritizing self-care, and maintaining a well-rounded life proved investor-worthy.

2. An Unwavering Ambition and a Desire to Scale: No investor wants to back a company by an individual who shows no ambition; they are looking for founders who have an innate ability to identify and seize growth opportunities. Investors want to see the hunger to grow and expand in the founders they choose to back. Without this hunger and drive, the potential to generate growth significantly decreases, while founders with grand visions and dedication are more likely to deliver substantial returns on investments.

3. A Results-Oriented Focus: Company culture and values are certainly important, but investors care most about tangible results. This motivates investors to take a deeper dive into a founder’s goal-setting and execution strategies, recognizing individuals who prioritize objective key results and have a proven history of delivering on their commitments as investment-worthy.

4. A Solution-Oriented Mindset: While visionaries often develop solutions to currently identified problems, investors want to see resilience in those they choose to back. The startup landscape is full of obstacles, more than what investors hope to solve with the mission of their companies, and investors look for founders who approach problem-solving with a positive, solution-oriented mindset. Being flexible and open to alternatives is an attractive personality trait to investors who want to back someone who adapts rather than dwells on problems.

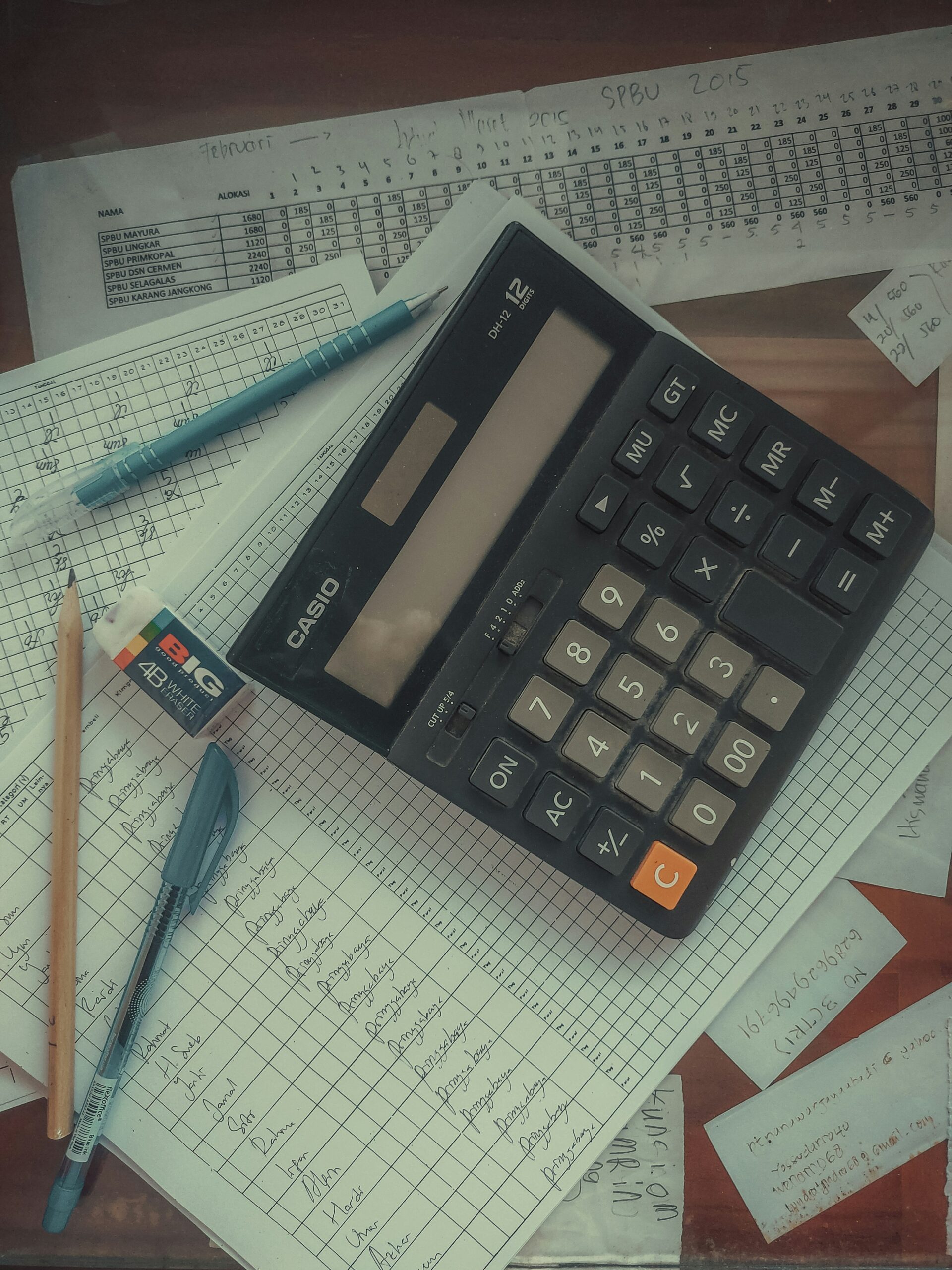

5. The Ability to Predict and Calculate Risks: Founders who can anticipate risk while taking ownership of both successes and failures are invaluable. Managing a team and your company during turbulent times while demonstrating a willingness to learn is a true asset to an investor.

While identifying the complex nature and true character of a founder is multifaceted, seasoned investors will often schedule multiple meetings to find those investor-worthy founders.