Image credit: Unsplash

After a tough 2023, the digital health startup market is showing signs of recovery, as recent research finds that startups have raised $5.7 billion in the first half of 2024.

Digital health strategy group and venture fund Rock Health’s researchers claim that, while slightly less than the first half of 2023 ($6.1 billion), the first half of this year reveals an uptick in smaller but more frequent venture capital (VC) deals, more early-stage deals, and a thawing IPO market. Already generating $5.7 billion in the first half of 2024, Rock Health reported the number of deals closed is increasing, with 266 closing in H1 2024 compared to 244 in 2023.

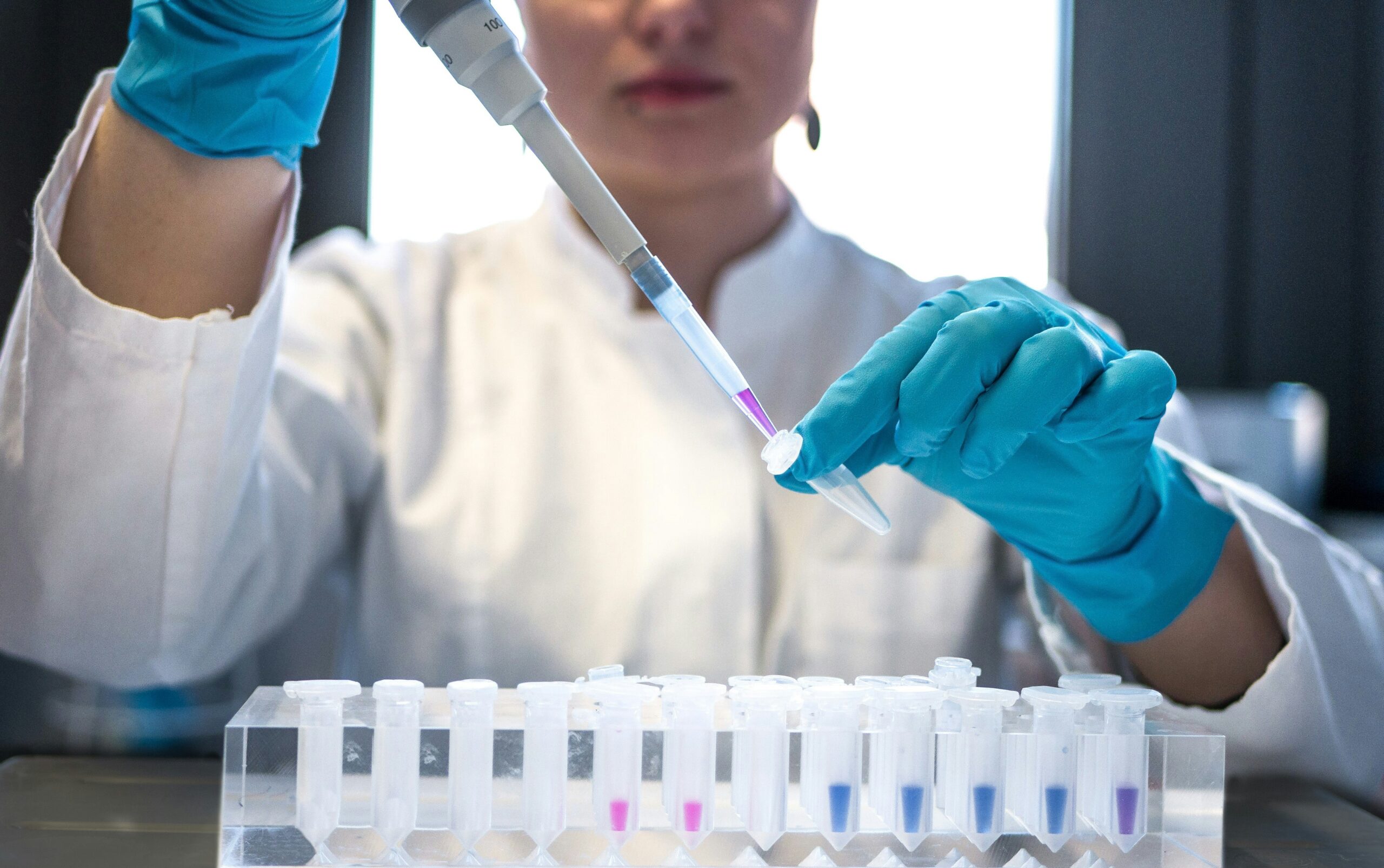

Rock Health’s report shows that the first half of 2024 saw most deals closed, around 84%, being early-stage ones. AI-focused digital health startups received a lot of VC attention in the first six months of 2024. Rock Health reported that 38% of those that raised Series A rounds deal with tech, and 34% of the overall dollars invested in digital health in H1 2024 went to AI-based startups.

Zephyr AI, an artificial intelligence (AI) precision medicine startup, was among some of the most significant Series A raises, closing a $111 million deal in March with funding from investors including Eli Lilly and Epiq Capital Group. Also among the large raises was biosensor startup Allez Health, which closed a $60 million Series A+ deal in May led by Korean in vitro diagnostics company Osang Healthcare.

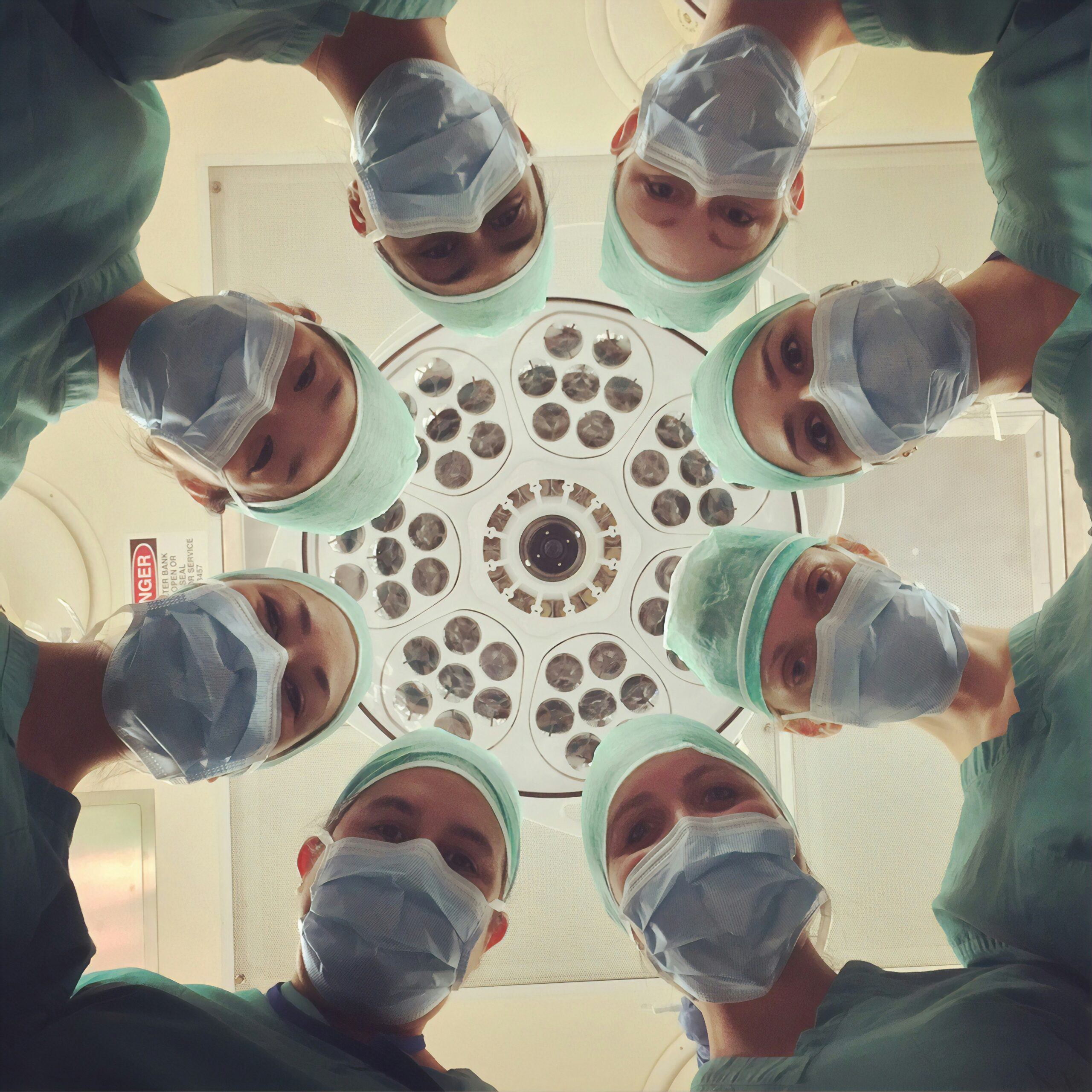

Rock Health did report that the most popular firms that grabbed VC dollars in the first half of 2024 were those focused on treating a specific disease or mental health.

Another attractive feature of digital health startup deals for the last several quarters has been unlabeled deals, which means companies are not attaching a name like Series A or B to the funding round. Researchers wrote in the report that “unlabeled rounds tend to spike during periods of transition between market conditions when startups need access to capital but don’t meet benchmarks for their next labeled raise and/or are trying to delay tough conversations on topics like valuation.”

However, the frequency of these unlabeled rounds is starting to fade, with deal marketing stabilizing and startups more financially equipped. According to a previous report by Healthcare Brew, the first half of 2024 shows a decrease in unlabeled deals, coming in at 40%, compared to 48% in Q1 of this year and 44% during 2023.

While the number of unlabeled rounds is still much higher than in the years before the pandemic, researchers believe the slowdown marks a shift toward a return to normality with labeled raises.

Rock Health analysts expect digital health startups to continue raising money. They believe that this market could generate more money and close more deals within the year than it did in 2023 and 2019.

“Funding momentum (especially at the early stage) and the tapering of transition measures like unlabeled rounds hint that we might be returning to more ‘normal,’ sustainable venture patterns,” Rock Health researchers wrote in the report.