Image credit: Unsplash

On Tuesday, venture capital firm Accel announced that they have raised a total of $650 million for a fund targeted at investing in Israeli and European early-stage startups. The fund is a sign that the venture capital market may be on its way to recovery.

Accel, which had been known for making fruitful early bets on such modern giants as Facebook and Spotify, commented on the fund in a press release saying it was raised to, “support ambitious founders building global category-defining companies” in Israel and Europe.

According to general partner at Accel, Harry Nelis, the European tech ecosystem has drastically evolved over the near-quarter century since the opening of its London office in 2000.

Nelis spoke in an interview and said, “The environment has dramatically changed since then.” He continued, “People would ask us, can Europe generate $1 billion outcomes?”

“Now, there are more than 360 venture-backed unicorns across Europe and Israel, and the whole ecosystem has evolved from one that raised about $1 billion in capital to now $66 billion in 2023.”

Nelis continued to expand on how Europe is producing a possibly more promising talent pool thanks to a “flywheel” of verified employees from other unicorn-status companies who are highly experienced and have become the founders of new companies themselves.

Accel released a report last year that cited Dealroom data, showing that a total of 248 venture-funded unicorns in the area had propelled 1,451 new tech startups across both Israel and Europe.

Separately, Nelis noted that investors aren’t paying as much attention to certain emerging geographies in Europe that are showing tremendous signs of potential in innovative technology.

Specifically, Nelis pointed to Romania and Lithuania as two examples of countries where substantial technology victories are flourishing. For instance, in Lithuania, the second-hand marketplace company Vinted has reached $4.5 billion “unicorn” company status. At the same time, in Romania, the company UiPath has obtained a total valuation of $10.9 billion in the public markets.

Presently, the firm expects to make significant investments in anywhere from 25 to 30 companies during its latest round of early-stage funding.

This is Accel’s eighth European fund, and its launch comes as funding for high-growth tech startups has dropped exceptionally low. This occurs as macroeconomic uncertainty triggered by Russia’s full-scale invasion of Ukraine, and along with increased interest rates from central banks, it’s resulted in a kind of reset in technology valuations.

Nevertheless, Accel’s ability to raise such a large fund suggests the seemingly grim environment for technology may be easing. This is evidenced by the firm managing to close its eighth fund for the region in two months.

Of course, this all comes after venture capital firm Plural raised €400 million in January for European startups. Additionally, World Fund, a climate-focused VC firm, raised €300 million in March.

CEO of seed investor Antler, Magnus Grimeland, spoke earlier this year on early-stage venture activity and private company valuations, saying they have scaled up modestly since the beginning of 2024. Grimeland expects Europe to follow suit.

“It’s on its way back,” said Grimeland. He continued, “We see a lot more activity in the portfolio. In New York, we made eight investments in January, and seven of them already have follow-on investments. The U.S. tends to always act quicker.”

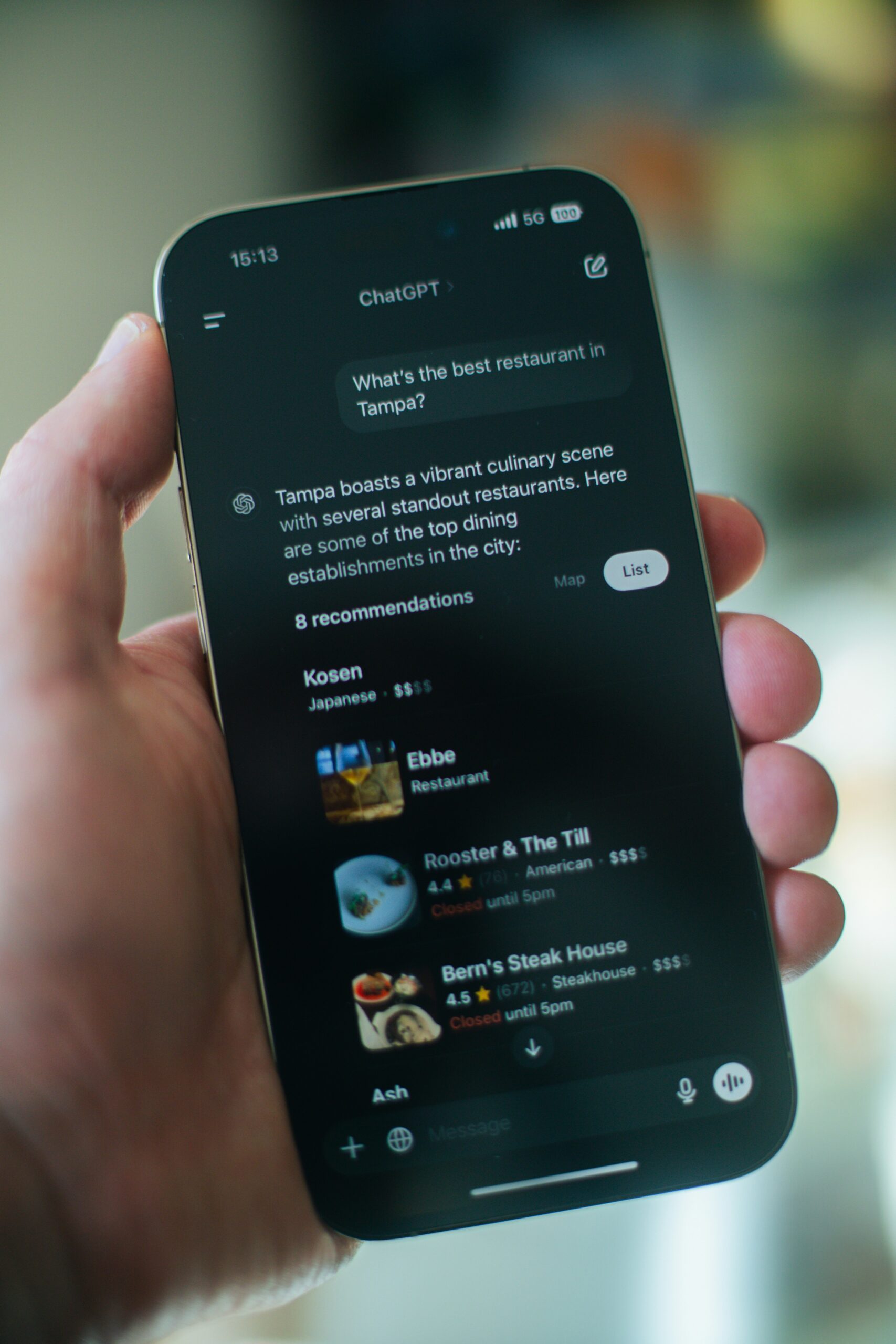

The investments come at a time when Europe’s AI opportunity is drastically increasing. Nelis said, “My expectation is Europe is going to generate some really interesting AI application companies.” He added, “The foundation layer is a layer where at least for now the U.S. incumbents currently have a real advantage — they have the advantage of compute power, large datasets, and lots of capital.”

CEO and co-founder of Synthesia, Victor Riparbelli, reportedly partnered with Accel last year. Regarding the funds raised for European and Israeli startups, Riparbelli spoke about his partnership with Accel, saying the company understands “how to strike the right balance between visionary and useful technology.”