Image credit: Unsplash

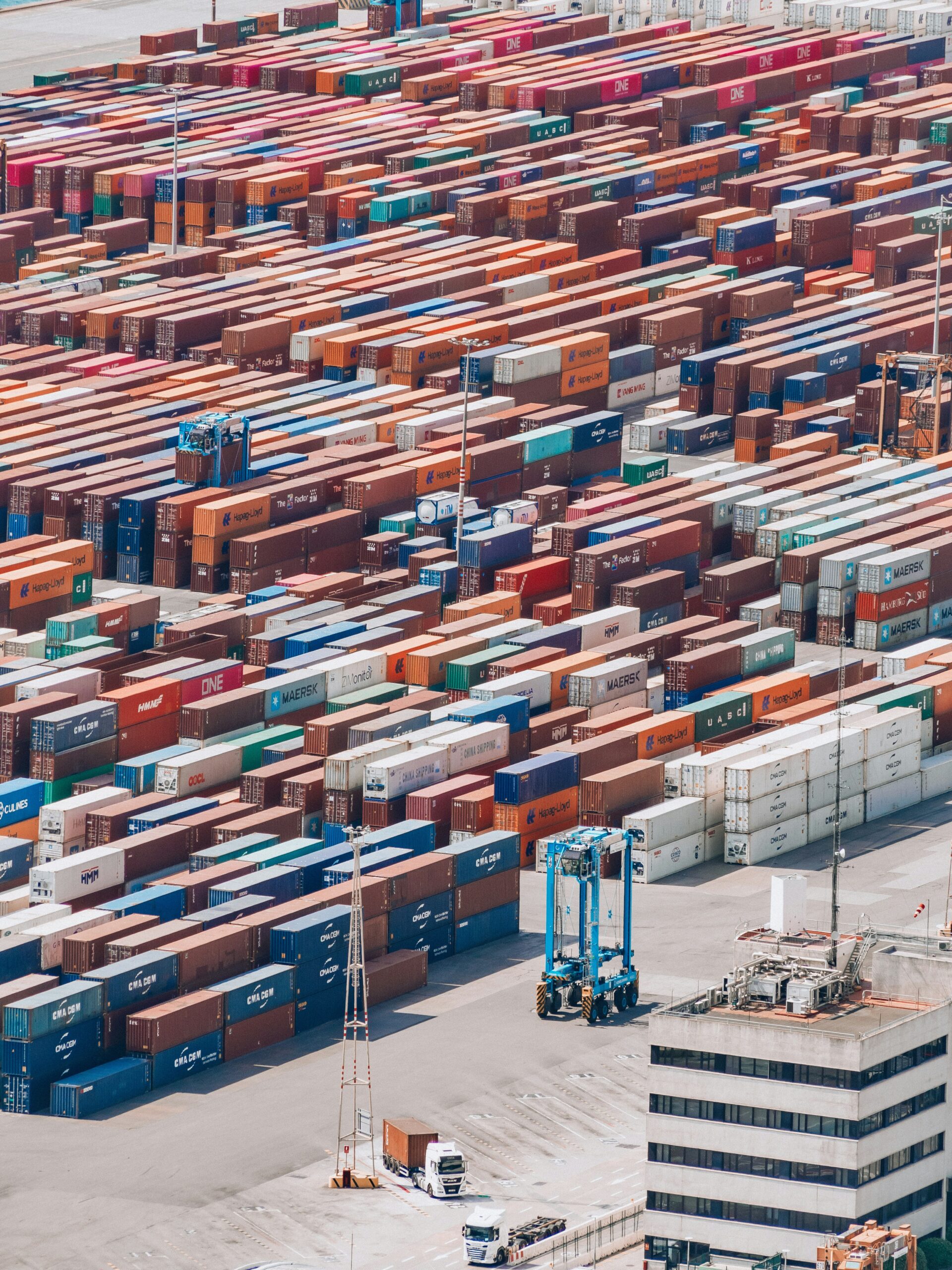

Growth stage VC firm G Squared recently announced that it has raised $1.1 billion of committed capital for its sixth flagship fund—G Squared VI. The growth-stage venture capital firm has been dedicated to supporting the capital needs of dynamic technology companies, which will continue with G Squared VI. To be allocated to secondary market opportunities, the majority of G Squared VI will offer growth capital and liquidity to the next generation of tech companies disrupting the market, as well as their stakeholders.

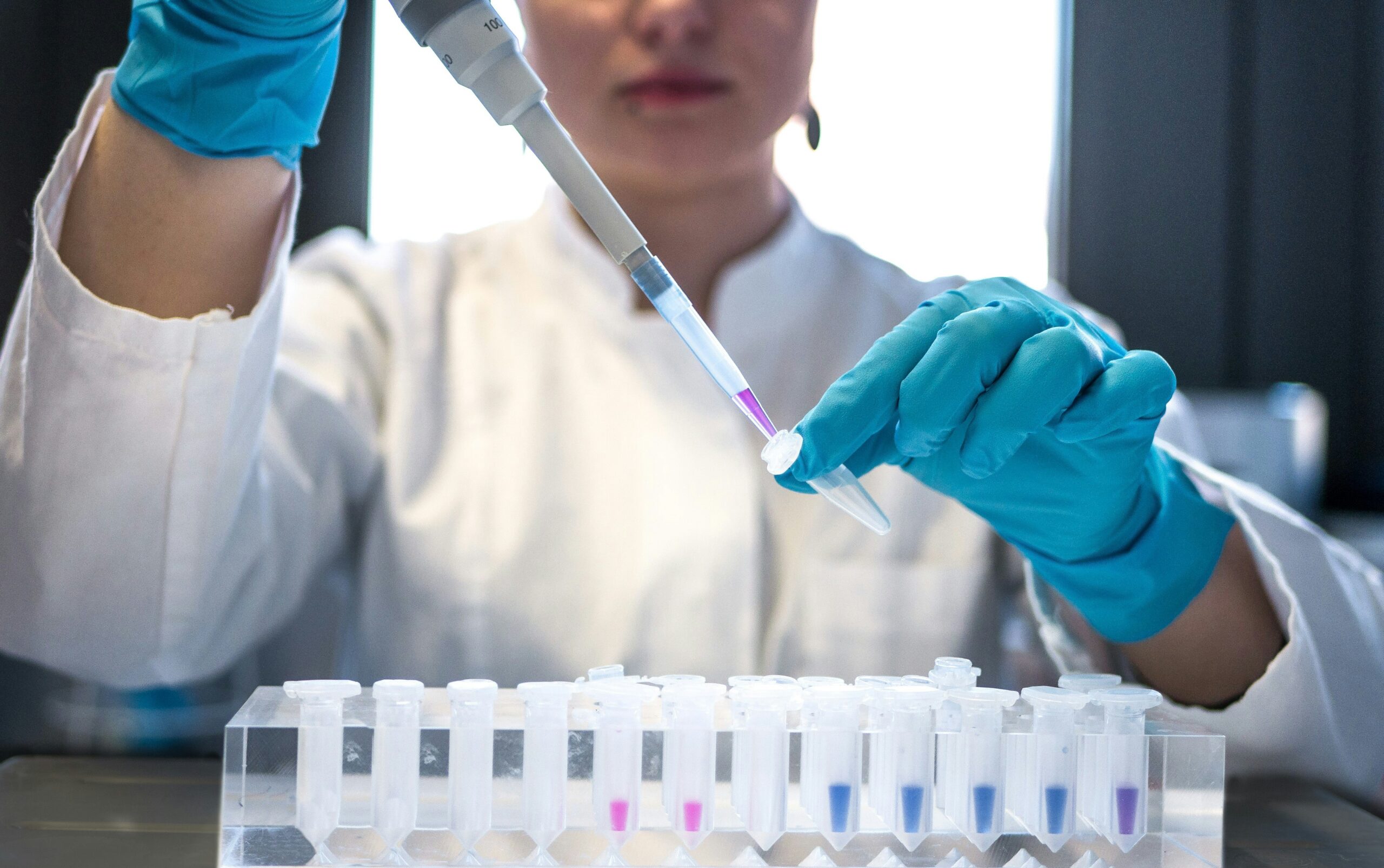

Founded in 2011, G Squared is a Chicago-based global venture capital manager that invests in companies tackling large problems, shaking up industries, and challenging the status quo. Since its founding, the VC firm has invested in over 130 portfolio companies. Some companies G Squared has invested in include Airbnb, Postmates, 23andMe, Chime, Goop, Lyft, and Spotify.

As an online music provider, what attracted G Squared to Spotify was its availability across the U.S. and throughout over 50 other countries around the globe. The unique music provider allows users to choose the artists, songs, and genres they desire to have on their playlists, which is a direct contrast to another popular music provider, Pandora.

Another company that has worked with the VC firm includes Instacart. G Squared likes this company because of its focus on delivering groceries and other household essentials in as little as one hour. Instacart already has over 500,000 items in its catalog from local stores, such as Whole Foods, Safeway, and Costco, with customers also able to mix items from multiple locations in one order.

G Squared deploys a differentiated investment strategy that delivers access and exposure to growth-stage technology companies across the globe. Recognizing that venture-capital-backed companies are staying private longer, and require primary capital to fund their continued growth and transitional capital to provide liquidity to stakeholders, G Squared partners with portfolio companies throughout their life cycles by using a fundamentally different approach than traditional VC firms.

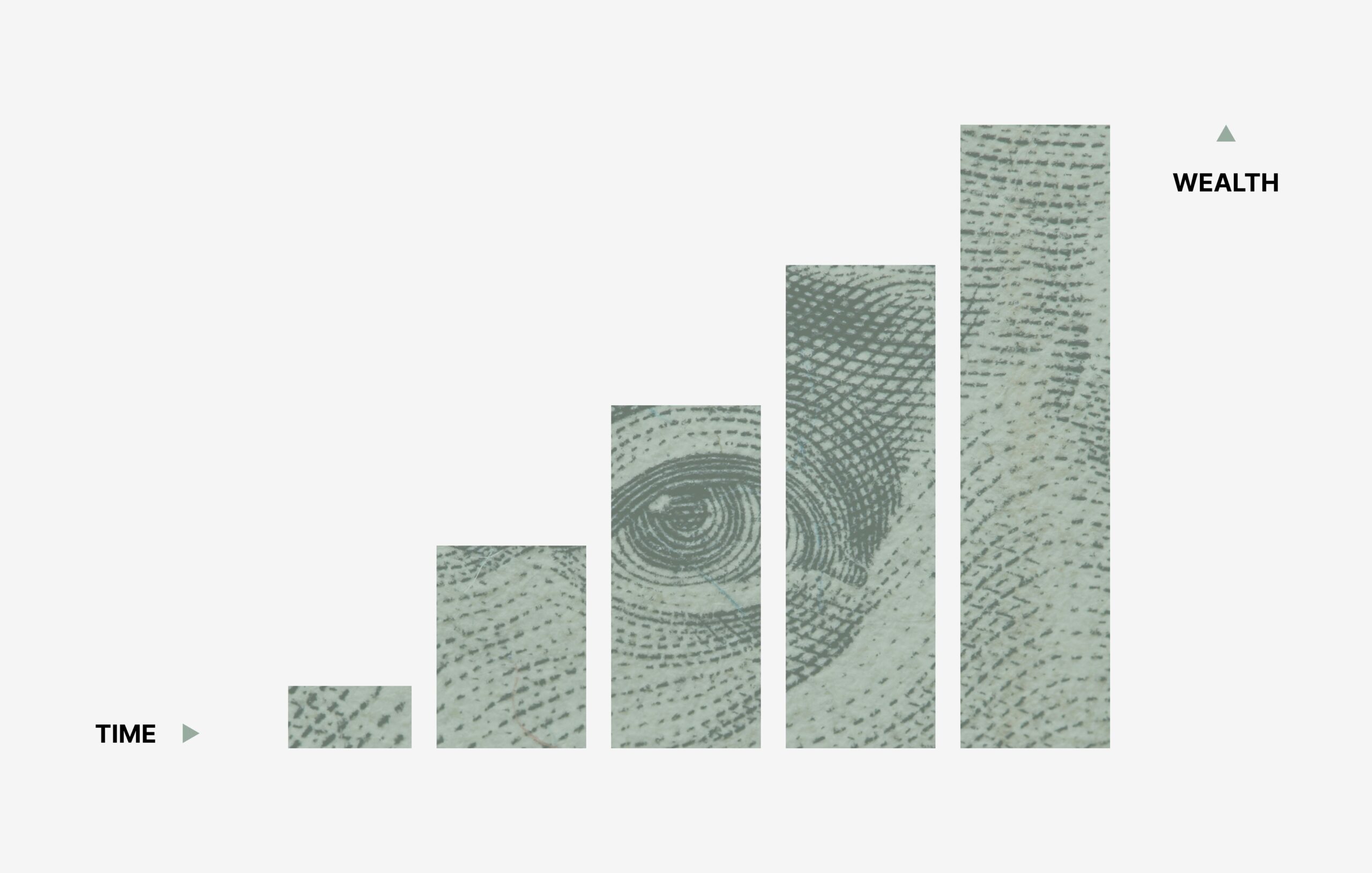

The $1.1 billion sixth flagship fund aligns with a moment in the market where secondary transactions have grown to exponential levels in the first half of this year, with numbers crossing the $70 billion mark.

“We are thrilled to have closed this substantial fund, which reflects the trust and confidence our limited partners have in our team and our strategic vision. G Squared VI will enable us to continue our mission of partnering with transformative companies that are shaping the future, while also leveraging secondary market opportunities to provide liquidity relief for the VC ecosystem,” stated Larry Aschebrook, founder and managing partner of G Squared.

The VC firm’s strategy depends largely on flexible capital deployment through a suite of liquidity services, which includes direct secondary transactions, primaries and structured primaries, company-sponsored tenders, and more, working in partnership with portfolio company management teams to drive continued growth. With G Squared VI, G Squared is focused on identifying and supporting visionary entrepreneurs in four core areas: SaaS, fintech and insurtech, mobility, and consumer internet.

G Squared is a global company that plans to remain steadfast in its mission of partnering with the best growth-stage tech companies throughout the world. As a transitional capital provider, leveraging structural inefficiency in hopes to methodically construct portfolios that offer the best access to value creation in private markets, G Squared will help create great conditions for pioneering leaders to shape the future through technology.

In addition to the capital in G Squared VI, the VC firm now has roughly $4 billion under management and has deployed $5 billion in capital to supporting leading companies, including Anthropic, Bolt, Coursera, Fanatics, FIGS, Tipalti, Toast, Turo, Uber, and Wiz.