Image credit: Unsplash

Many founders of businesses have high hopes that their startups will continually raise larger funding rounds at escalating valuations. However, unexpected challenges, such as a global health crisis or a surprising surge in interest rates, can significantly impact a company’s ability to maintain its valuations.

Some of these startups may have to resort to down rounds, new financings at a lower valuation than the company’s previous price points. While founders and investors try to avoid down rounds, these deals do not necessarily impact a startup’s future.

Resetting the Game

Nikhil Basu Trivedi, co-founder of Footwork, said onstage at TechCrunch Disrupt 2024, “Our first investment, when we started our firm in 2021, was a down round recap of a company that had to have a total pivot during COVID.”

Trivedi added, “Their initial business was in the college housing market, which got decimated the moment the pandemic hit.”

Basu Trivedi said Footwork reset the company’s cap table and created a new stock option pool for the entire team. Trivedi added that the company’s new business, which happened to be a subscription platform for restaurants called Tavble22, “managed to survive and thrive from that experience.”

At the beginning of November, Table22 announced an $11 million Series A that Lightspeed Venture Partners would lead.

Though all companies that have a down round have a complete revival, Elliot Robinson of Bessemer Venture Partners stated onstage at TechCrunch Disrupt that if a company is struggling in business, “there’s a pretty good likelihood that someone else in your space or a competitor is dealing with many of the same challenges.”

Robinson went on to encourage startups in these positions to stay their course.

“If you’ve taken a down round, that’s okay,” he stated. “In a tough market environment, that can actually be a win. You might not see it or feel it until four or six quarters out, but a lot of the time the market can open up to you if you want to stick with it.”

The Fear of Valuation Hits

Companies that took valuation hits include Ramp, which was valued at $5.8 billion last year (down from its previous $8.1 billion price). The fintech gained some of its value in April when Khosla Ventures priced it at $7.65 billion.

Down rounds were not common during the pandemic-era boom, but their prevalence has more than doubled, from 7.6% in 2021 to 15.7% in the first half of 2024, according to data from PitchBook.

Startup prices also dropped significantly after the US Fed hiked their interest rates, and many companies have remained overvalued relative to their performance, according to Dayna Grayson, co-founder at Construct Capital. Some companies are considering down rounds, but these deals are stressful for many founders.

“I think the scariest thing for a lot of founders is how to manage morale,” Grayson has stated. “But you can absolutely incentivize people through down rounds.”

Incentivizing Teams

Robison–who has guided three portfolio companies through flat or down rounds in the past year and a half–explained how investors motivated their employees and executives of one of these companies that remain committed after a down round.

He stated that while everyone at the company experienced valuation losses, investors established a bonus pool to reward the entire team with bonuses if they could achieve a 60% revenue growth. Robison added that founders and top executives would receive additional equity if they achieved these revenue targets.

“That allowed us to make the company-wide and executive goals very transparent,” he added, adding that it “reminded people that the core underlying business is still solid.”

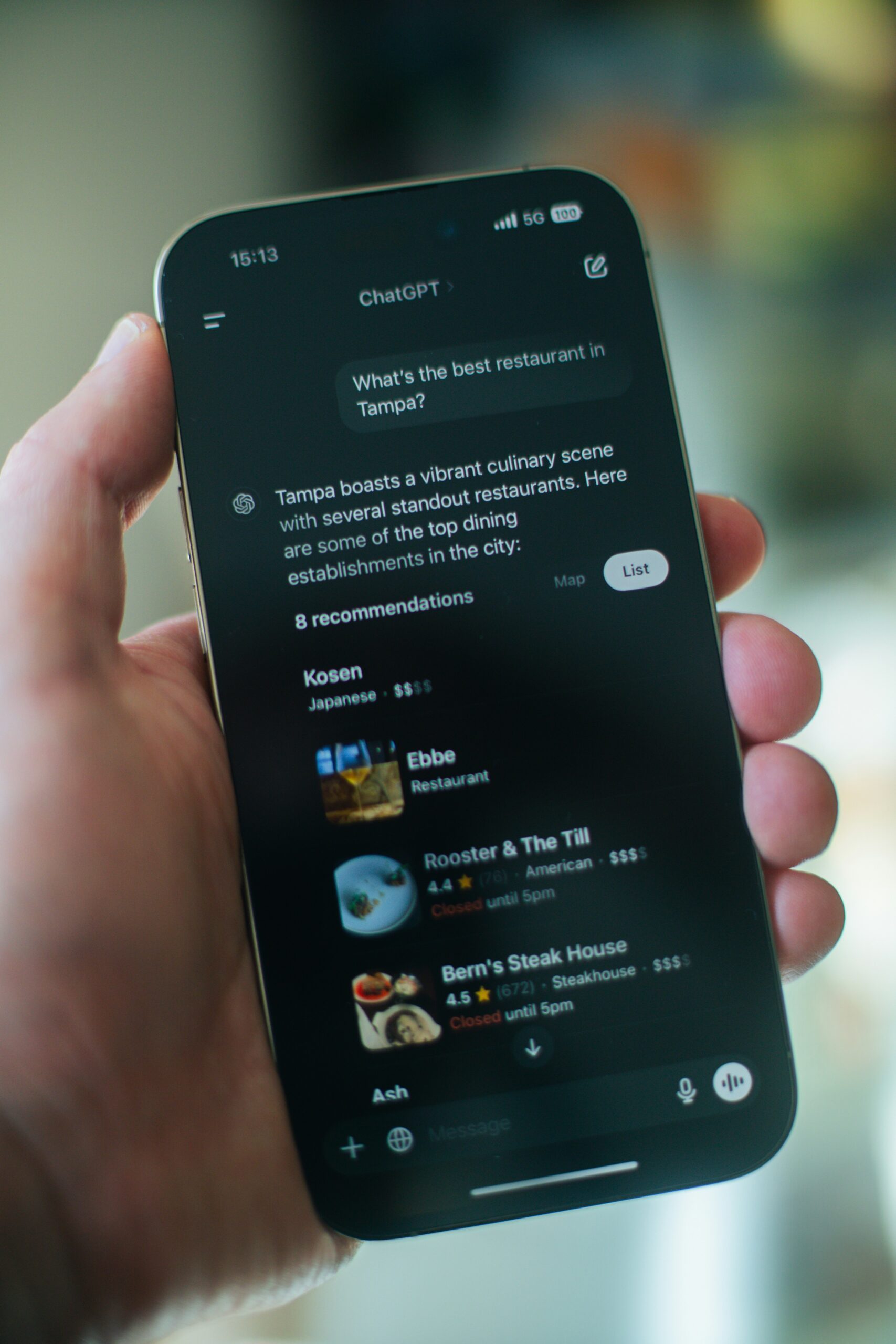

Some also need clarification on what will happen with AI companies raising capital at high valuations.

“I think it would be hard to argue there are not overinflated valuations in the market now,” Grayson stated.

Basu Trivedi, who invested in several AI companies, including AI detector GPTZero, said that many artificial intelligence companies “have the fundamentals to justify the hype and valuations.” However, he added that it is still hard to tell which AI companies will succeed.

“Some of these categories are so competitive,” he stated. “There’s like 20 companies doing something really similar.”