Image credit: Unsplash

Investors may be showing more caution and reserve when approached by founders looking to see their company’s future come to life, but Iceland’s startup scene is certainly batting above average due to the country’s tech ecosystem’s robust development in recent years. Attracting the most venture capital per capita of all Nordic countries in 2023, though the statistic is slightly skewed by Iceland’s relatively small population of less than 400,000 inhabitants, Icelandic startups are seeing an increased interest from foreign co-investments, which provides clarity on why VC firms raise more funding in the country. A perfect example is Frumtak Ventures, which just closed its fourth fund at a staggering $87 million.

While the firm’s fourth fund far exceeds its third, which equated to $57 million, Frumtak has already demonstrated success. It has a solid track record, but the firm hasn’t disclosed any returns quite yet, particularly when its third fund has been too recent to highlight any. General Partner Andri Heiðar Kristinsson stated, “The second fund performed really, really well.” Kristinsson further went on to explain how the fourth fund was partly made possible by many of Frumtak’s limited partners, who are Icelandic pension funds. The general partner stated, “We were in a very good position, and all our existing LPs were happy to back us again.”

Iceland’s tech scene leans toward early-stage startups, and Frumtak is no exception, with their name even translating roughly to “early catch.” While venture capital is relatively new in Iceland, the firm is positioningitselfs to be run “by entrepreneurs, for entrepreneurs,” according to its managing partner Svana Gunnarsdóttir, a former founder herself.

Because of the country’s relatively small population and cultural factors, Icelandic startups tend to look abroad early on in their development. And since there are only a handful of VC firms in Iceland, many VC firms in the country often co-invest. While Frumtak will continue to back Icelandic founders regarding geographic scope, Kristinsson stated the firm will “focus on local innovation with global potential.” A great example is Frumtak’s portfolio company, Sidekick Health, which went global with its gamified digital care platform with partners such as U.S.-based Anthem.

While Frumtak is willing to invest in companies based abroad, they are looking for Icelandic entrepreneurs, like U.S.-based Activity Stream, a data platform for the live entertainment industry. “If any of [Frumtak’s] portfolio companies are going to be successful, they’re gonna have to be thinking outside of Iceland,” the company’s CEO, Einar Saevarsson, stated.

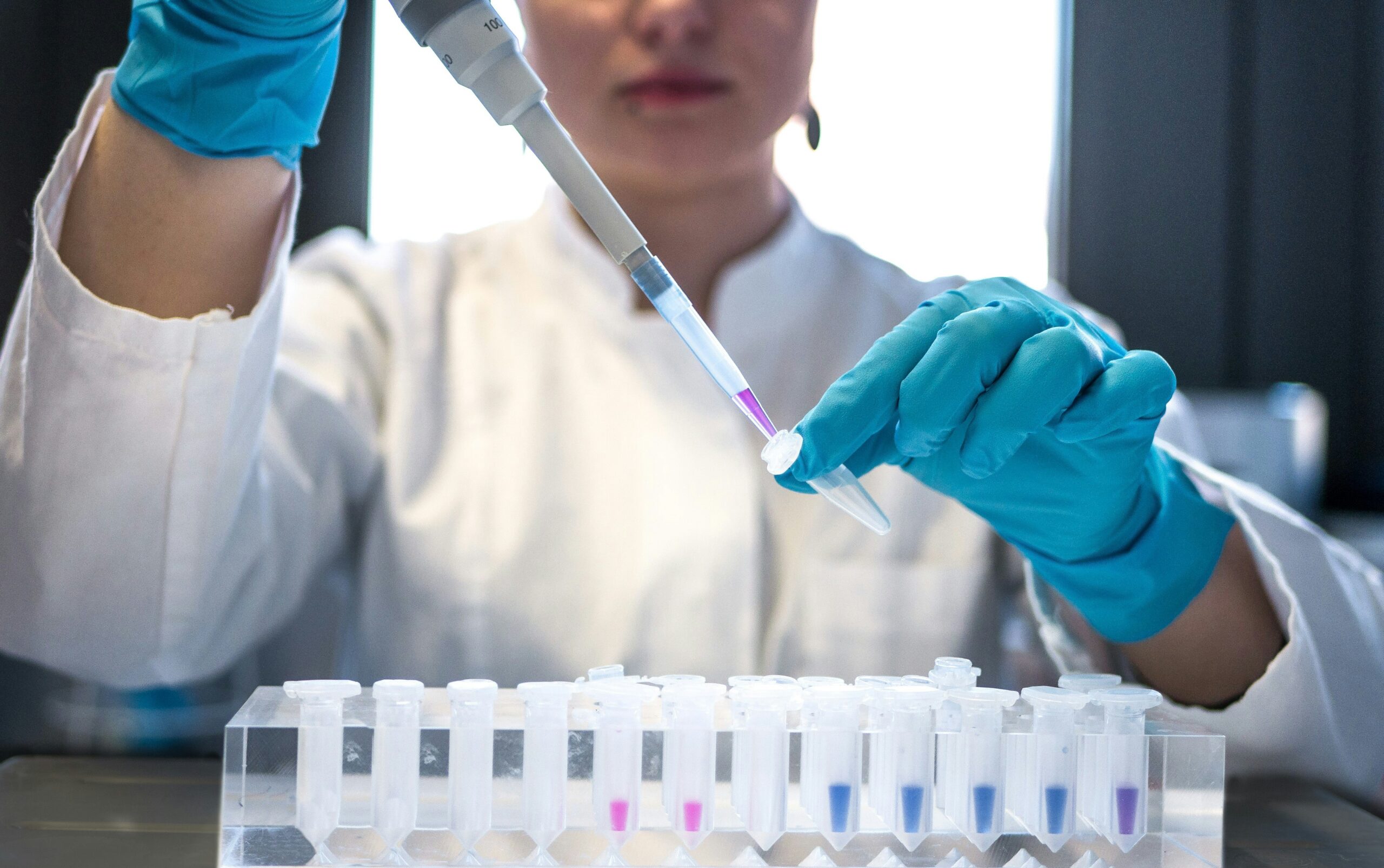

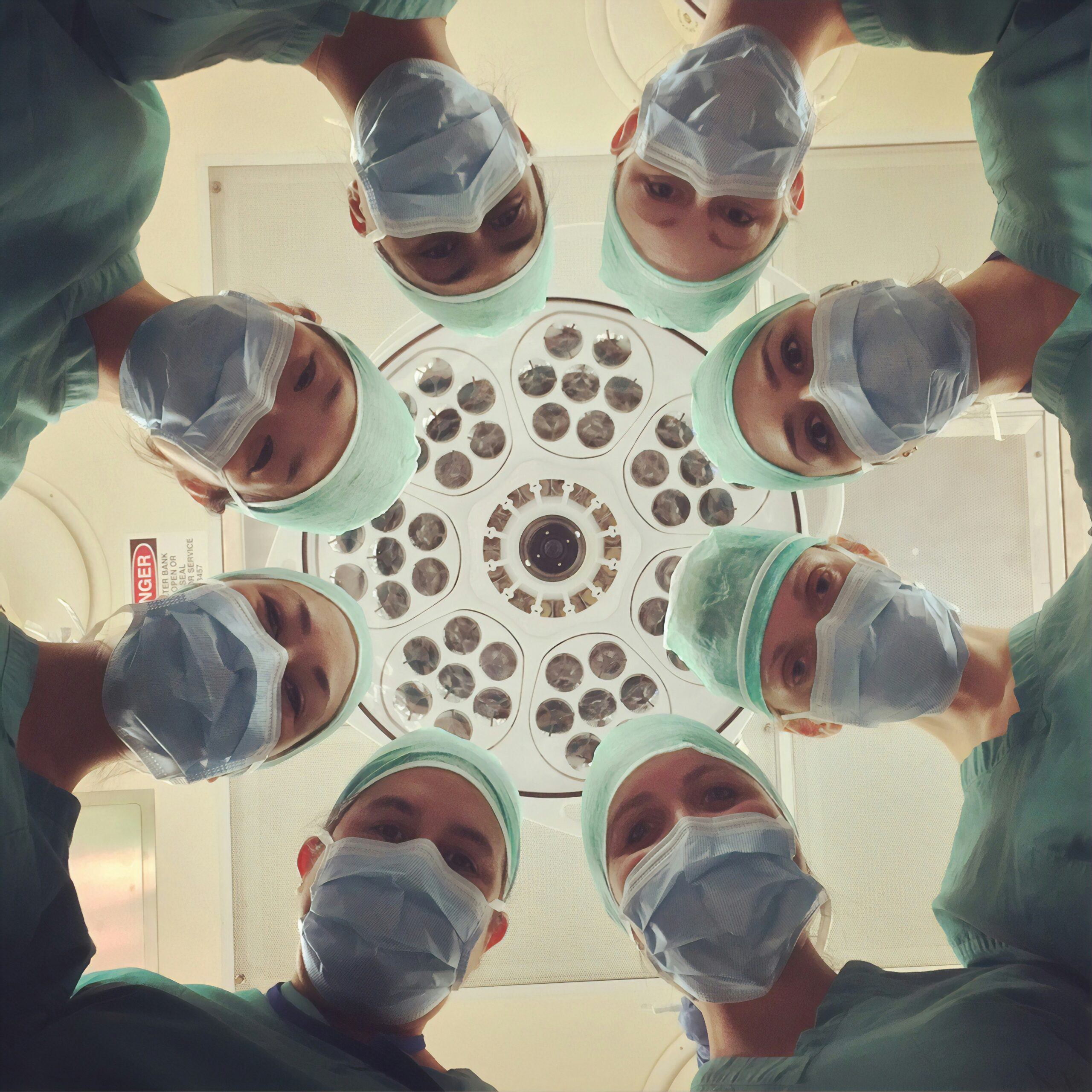

Frumtak is also more focused on working with global firms investing at the Series A, B, or C stage, also getting a deal flow from local acceleration programs such as the ones led by KLAK, which Kristinsson co-founded. Interested sectors Frumtak stated it will consider investing in are “at the intersection of software, AI, and deep tech in industries playing on Iceland’s historical strengths in areas such as ocean tech and logistics, healthcare, travel, energy, climate, and gender equality.”

But Kristinsson said one thing won’t change: Frumtak will remain “super hands-on. We always take a board seat, work relentlessly with our companies, and say that we want to be the first call for founders, both in good times and in bad times.”