Image credit: Unsplash

Exploring Tangible Investments as Alternatives to NFTs

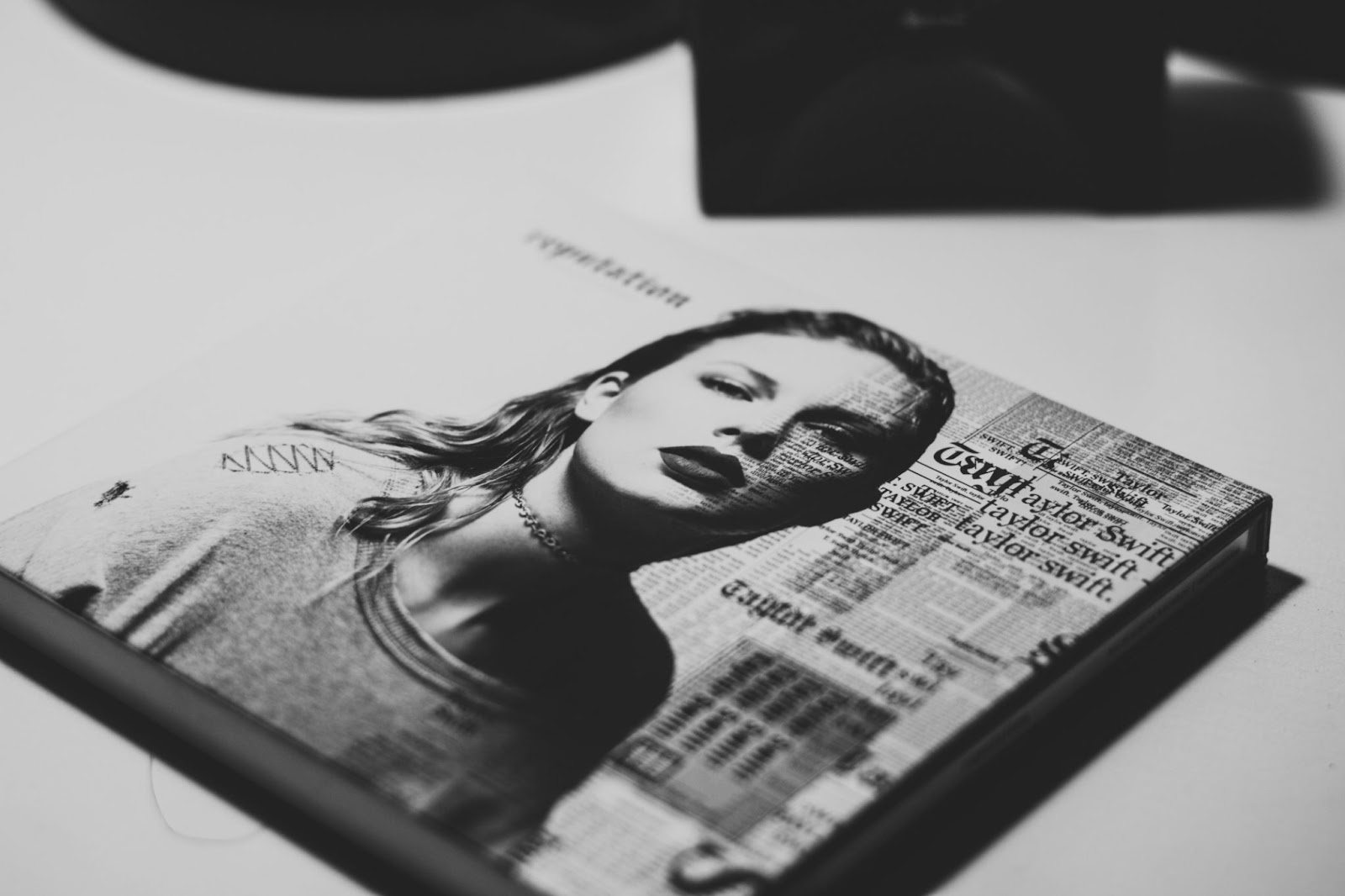

While there may be a lot of hype around NFTs, digital assets that represent real-world objects like music, art, and videos, there is another investment option that has been popular for ages—tangible investments. For those seeking alternative options to NFTs for investment, tangible options are available to help value preservation and diversification.

Standard types of tangible investments include real estate, gold bullion, art, antiques, wine, and other collectibles like watches, cars, and jewelry. The investment options can aid in offsetting any risks of putting money in the stock and bond market, often showing a positive correlation with these markets while also adding the benefit of being an item you can derive enjoyment from.

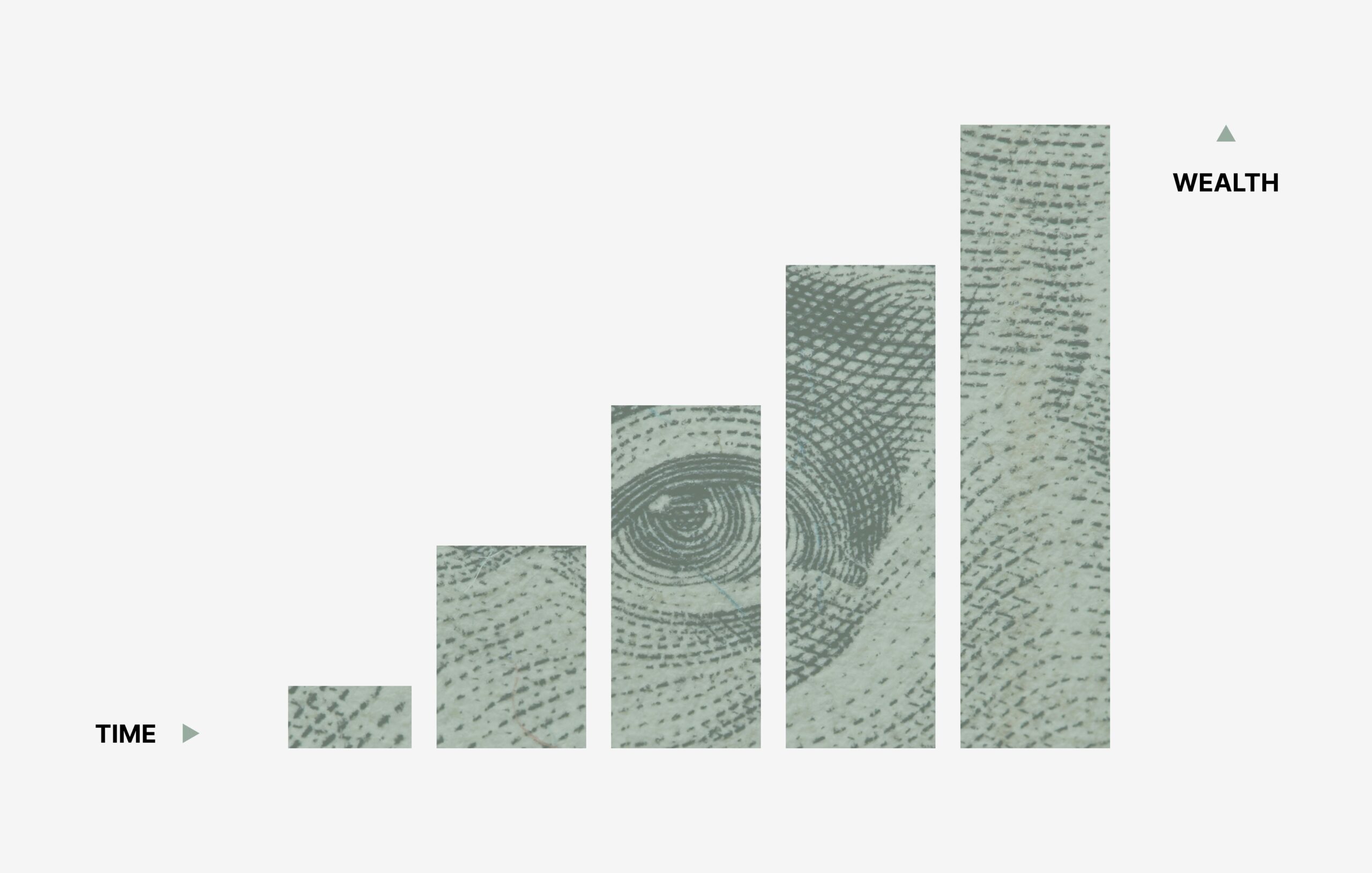

The biggest argument for alternative investment options, however, is the protection from inflation they offer. While the power of spending the pound has been seriously destroyed in recent months, gold as a tangible investment has gained in value by 12% this year alone so far.

Tally Money CEO Cameron Parry said: “Gold is a time-tested inflation hedge and has maintained its purchasing power for millennia. At times like these, when conventional money is steadily losing its buying power, gold offers people the best chance of keeping ahead of inflation.”

Tangible assets offer other benefits besides protection from inflation, like lower investment costs. For example, wine investments can have a lower entry point, costing as little as £500. Also, with the current alcohol duty freeze, investments in assets such as Scotch Whisky, which has no capital gains tax, have become another popular option.

These alternative investment options also have the potential for huge returns. For example, an investment of £4,700 27 years ago in cask whisky secured one investor a whopping £225,000 following a sales agreement with Whisky Investment Partners—a 4,600% return.

Other tangible assets that are outperforming include gemstones, which are showing strong performances in the jewelry market—with Colombian emeralds jumping in value by 2,000% over the past decade.

Another advantage of alternative investments is the great tax benefits that some have. Wine, cars, and stamps are all viewed by HMRC as wasting assets so no tax is payable even if you make a great return.

Diversifying with Tangible Assets: A Guide to Smart Investments

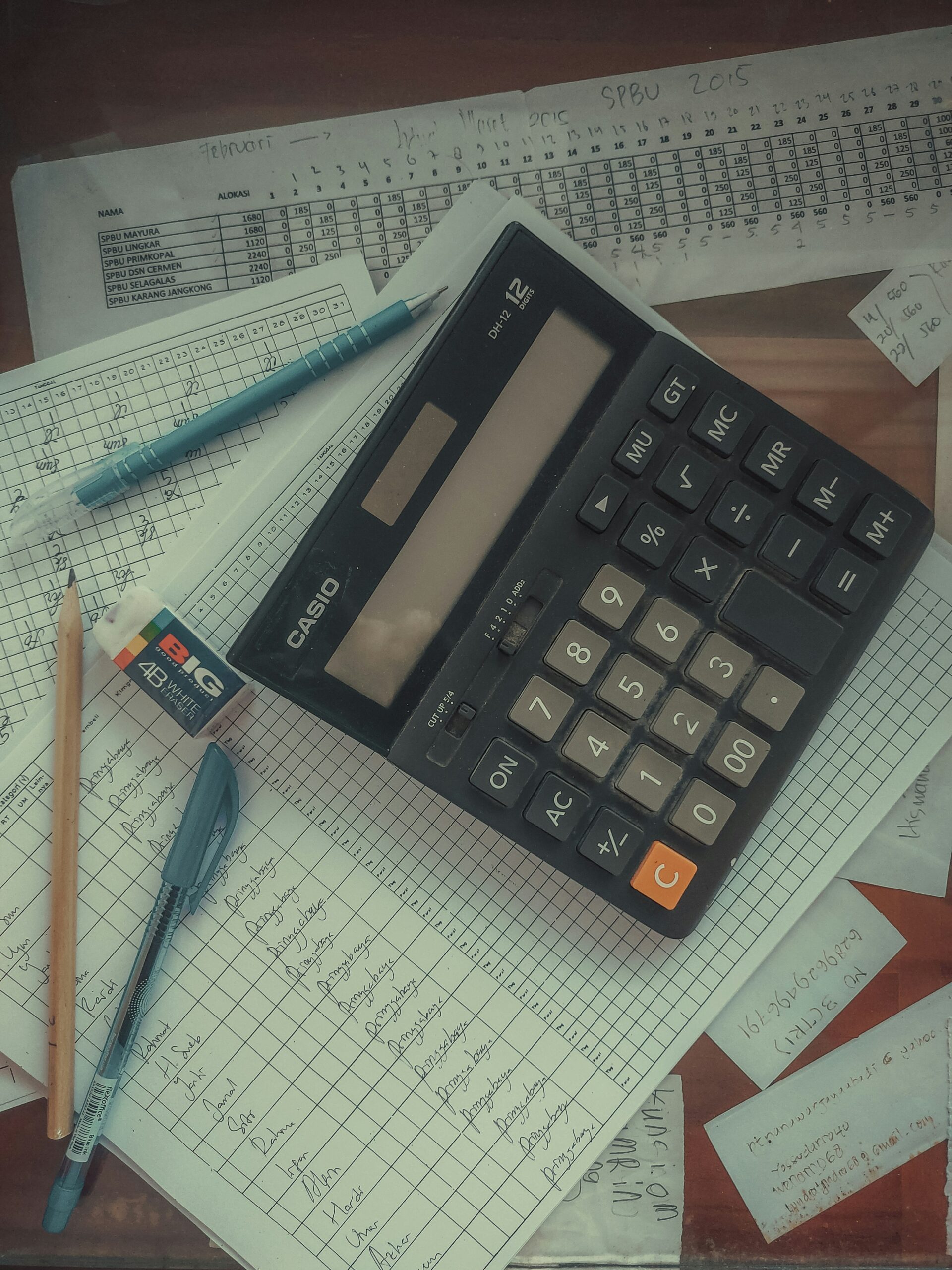

However, when considering the range of alternative investment options, you will first want to do your research on the asset class itself and the associated risks, as some classes are more susceptible to theft, fraud, and counterfeiting—so you will need to take additional steps to protect yourself. One way to offset risks is to work with regulated firms, as long as the assets are not so new that the regulators haven’t yet stepped in.

“All investments carry risk, but some are riskier than others and a first step should be ensuring that the class aligns with your risk appetite. Never invest more than you can afford to comfortably lose,” advises Chantelle Arneaud, director of strategy at Envestors. Arneaud further stated, “You’ll also want to understand the broader factors that could impact your return—that could be the weather if investing in commodities, economic recessions or a lack of a sustained interest.”

Also, exchanges, wealth managers, and brokers all come along with fees, but some asset classes have other associated costs beyond this. Certain collectibles, like fine art, can require you to hold and insure the items, so you will need to understand and factor in additional costs before making any investments.

Once you have decided which alternative asset class you want to add to your portfolio, you will want to choose who to invest through. There are platforms available for investors in most asset classes looking for options other than a wealth manager. However, whenever possible, you will want to work with a regulated firm with a solid reputation that can offer strong protections for you.