Image credit: Unsplash

Funding for European startups rose to nearly $16 billion in Q2 of 2024, exceeding funding for Asian startups per quarter for the first time in a decade. Crunchbase found that Asia-based startups suffered their worst quarter since Q4 of 2015.

European startups experienced a surge in both early and late-stage funding, with an emphasis on late-stage. Funding was up 31% quarter over quarter and 17% year over year, according to the analysis of Crunchbase’s data.

The UK was the leading market with $6.7 billion, followed by France with $2.9 billion, with both countries up in year-over-year funds. Despite being down this quarter, Germany was the third largest market in Europe, with $1.8 billion invested there.

France’s surge in funding was especially apparent in Paris. Startups based in the city also generated some of the most significant acquisitions this past quarter. London-based PE firm Bridgepoint acquired a majority stake in Paris-based employee hub LumApps for $650 million. Mobile gaming company Voodoo acquired Paris-based social networking app BeReal for around $500 million. US-based LexisNexis acquired the Belgium-based AI legal drafting service Henchman in the artificial intelligence sector. While it was not the biggest deal at $160 million, the acquisition indicates a strong future for AI companies.

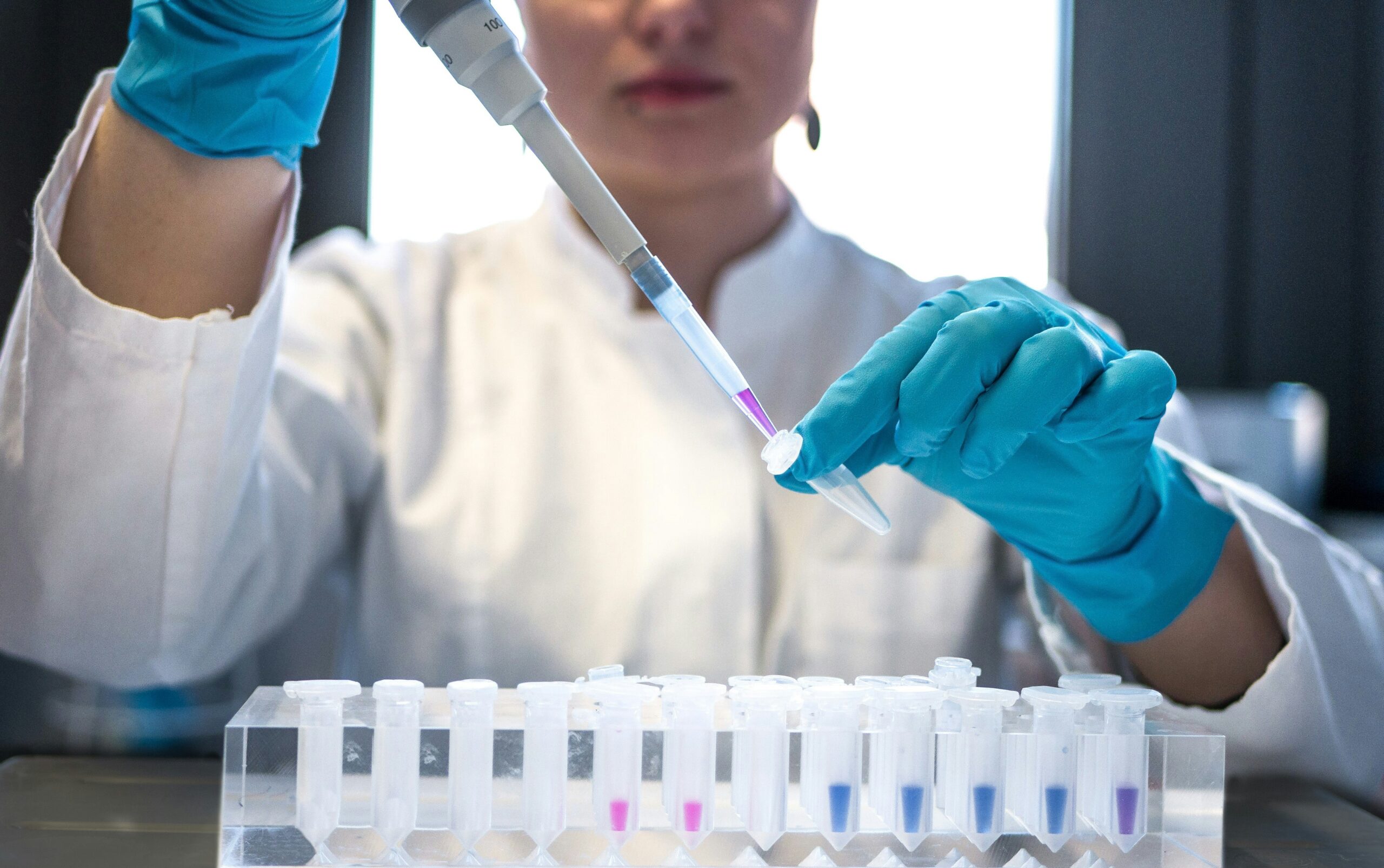

AI was the leading industry globally, with $3.3 billion invested in European AI businesses during Q2. Significant investments were made in the London-based automated driving company Wayve, the Paris-based foundation model Mistral AI, and the Cologne-based language translation platform DeepL. Financial services was the second-largest sector, with $3 billion in funding raised. UK-based companies Abound, GB Bank, and Monzo raised the most significant rounds. Notably, $2.5 billion was invested in renewable energy companies, making it the third-largest earner of the quarter.

Early-stage and late-stage funding grew during Q2. Early-stage funding reached $6.5 billion across 300 funding rounds, with series B funding showing the most significant increase year-over-year. Late-stage financing rose to $7.5 billion across more than 100 rounds. Over the past five quarters, quarterly totals have fluctuated, with late-stage funding surging and falling unpredictably. Funding was up the most quarter over quarter and year over year this past quarter, but Q2 was not the highest quarter in the last year.

Three European companies joined the unicorn board in Q2: Paris-based forecasting service Pigment, Berlin-based auto parts retailer Autodoc, and London-based no-code app developer Builder.ai. There are 208 European companies on The Crunchbase Unicorn Board.

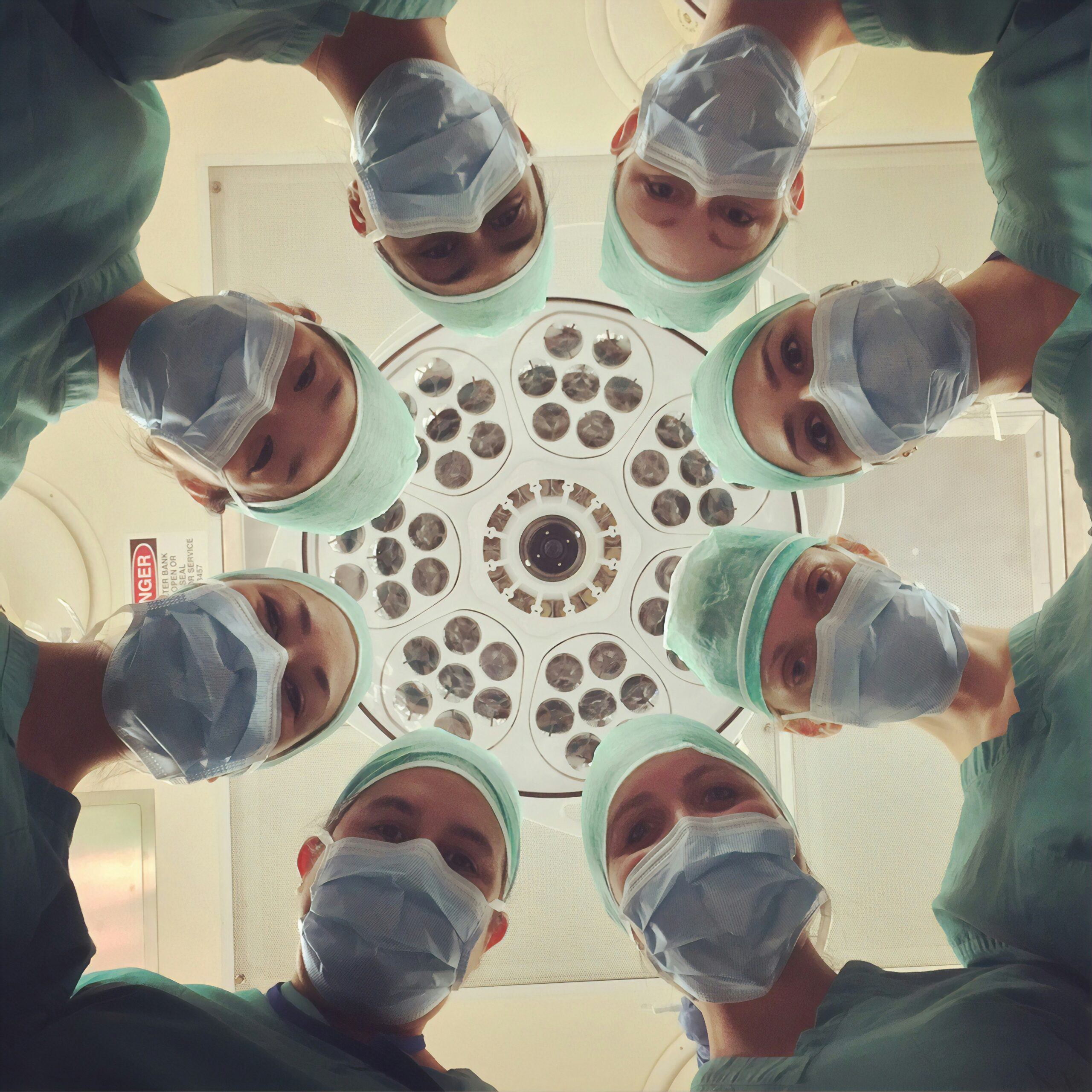

Fintech unicorn Revolut posted its 2023 earnings, which show strong revenue growth, a good sign for Europe in general. Revolut posted 95% year-over-year growth, with $2.2 billion in revenue for 2023 and a profit of $545 million. The company also amassed 12 million new customers, a significantly positive trend in one of Europe’s most highly valued private companies. Revolut was last valued at $33 billion in 2021.

The climate for startup funding in Europe is looking good overall. This quarter showed an increase in late-stage financing for mature startups, and AI, the most prominent sector, took the lead in funding. Revolut’s substantial growth is another positive sign for the region.