Image credit: Unsplash

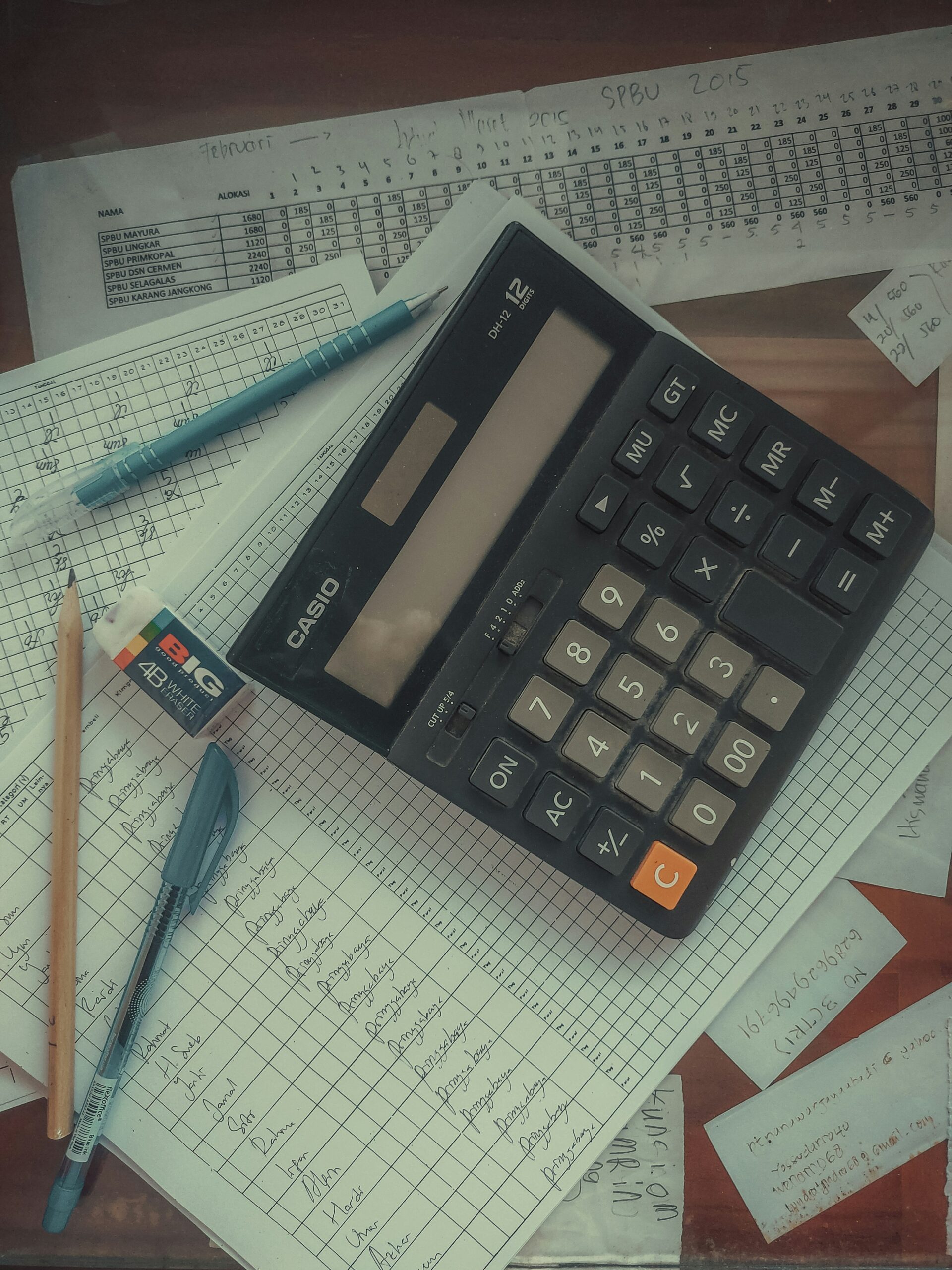

The luxury real estate market is constantly making headlines, but 2024 has been especially dramatic so far. As the market continues to adjust to a post-COVID world and the supply-and-demand imbalances it brings, the year has brought with it many different stories, from homes selling for incredible sums to those sitting vacant and unsold despite prices set far below the norm. The first quarter of 2024 has told an interesting story, but the unprecedented growth it displayed has come as a surprise to many.

A report by Redfin broke the news of a historic surge in real estate prices from one US coast to another. Luxury homes, in particular, displayed a remarkable uptick, with the median price soaring by 9% year-over-year to reach an unprecedented high of $1.225 million. This surge surpassed the growth rate of non-luxury homes, where the median price increase was only 4.6%, reaching $345,000 compared to the previous year.

Disparity in Real Estate Markets

There continues to be a significant disparity trend in the larger real estate market, separating overall sales from luxury sales. While overall US real estate sales underwent a 4% decline in the first quarter, luxury real estate sales increased by 2.1%. Luxury homes, typically representing a smaller segment of the overall market, have distinct dynamics influenced by factors such as interest rates, housing supply, and myriad factors in surrounding industries and areas. These high-end properties cater to affluent buyers with different motivations and financial capacities, often resulting in trends that diverge from those of the broader housing market.

Cash Purchases, Supply, and Demand

One of the key drivers behind the discrepancy between luxury and non-luxury home sales is the prevalence of all-cash purchases among affluent buyers. This trend shields luxury buyers from the impact of high mortgage rates, which hovered between 6.62% and 6.9% in the first three months of the year. Cash transactions eliminate the need for financing through mortgage lenders, sparing buyers from interest charges and fluctuations in mortgage rates. Additionally, cash offers provide a competitive edge in real estate markets, often resulting in quicker transactions and preferred terms for sellers.

The report indicates that nearly half of all luxury homes were purchased with cash in the first quarter, marking the highest share in at least a decade.

Despite the surge in luxury home prices, new listings for upscale properties experienced a significant increase of 18.5% in the first quarter. However, this surge in inventory remains below pre-pandemic levels, indicating a persistent supply-and-demand imbalance in the luxury real estate market.

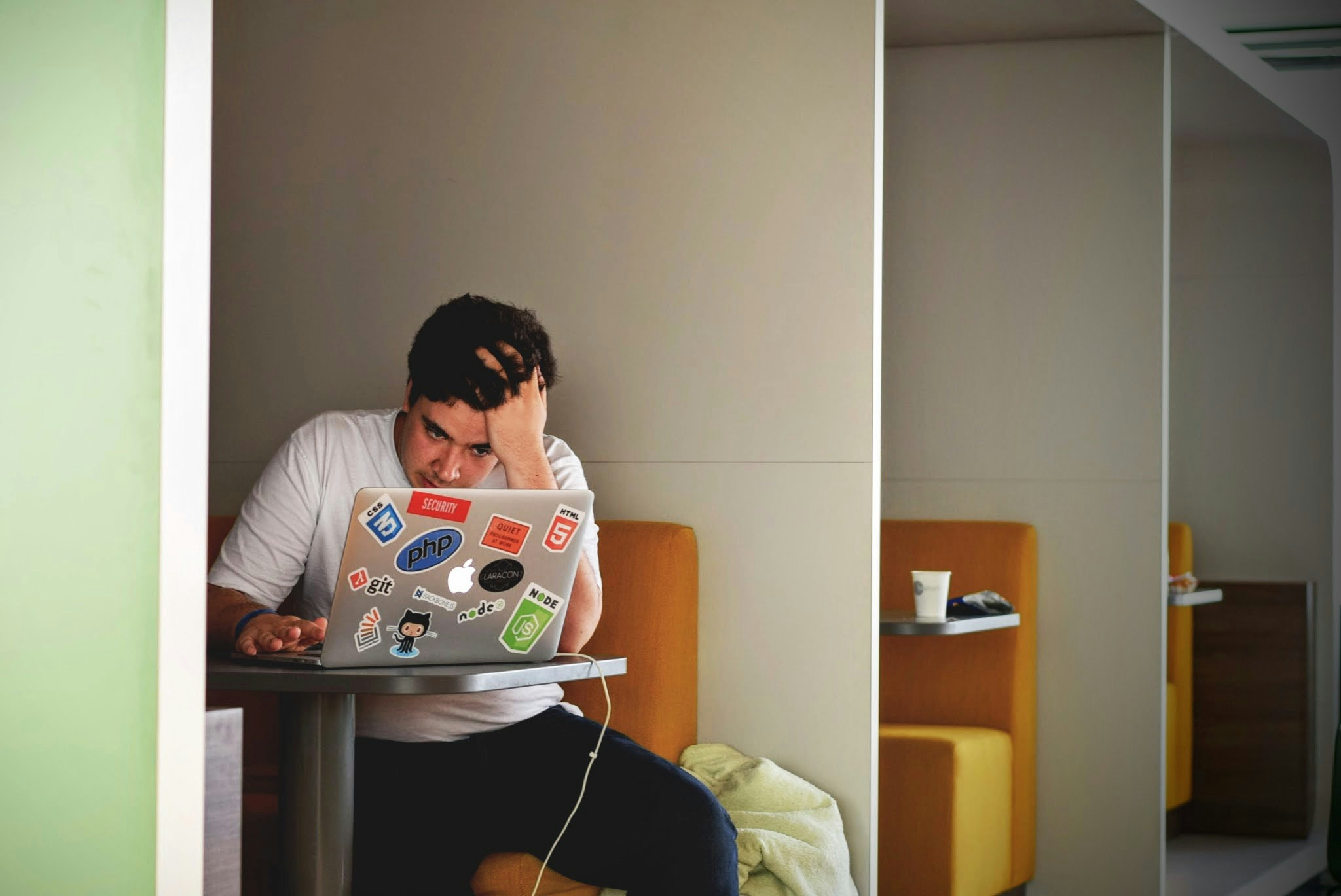

A Shortage of Available Homes Creates Problems for First-Time Buyers

The real estate market continues to witness a persistent rise in home prices despite challenges like high mortgage rates and affordability concerns. Median existing home prices have climbed for nine consecutive months, outpacing wage growth and creating difficulties for first-time buyers. However, the market remains strong due to a shortage of available homes, with economists predicting further price increases in 2024. While a modest market correction may occur, significant price drops are unlikely due to strong homeowner finances and cautious building activity.